Which of the Items Below Is Not a Business Entity

The most common forms of business are the sole proprietorship partnership corporation and S corporation. Which of the items below is not a business organization form.

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

A Limited Liability Company LLC is a business structure allowed by state statute.

. Limited liability companies corporations partnerships and. A Venture entrepreneurship B Proprietorship C Partnership D Corporation. A sole proprietorship is a business that is directly owned by a single individual.

Which of the items below is not a business entity. The term business entity is often used when the company is a legal entity that actually has a physical location. The type of entity determines how a business is taxed and its owners or owners exposure to liability.

There are important flavors of each class of business entity. Which of the items below is not a business organization form. Hence the correct option is A.

Which of the following accounts is a liability. Which of the items below is not a business entity. Corporation proprietorship partnership entrepreneurship.

The people who run an LLC are called managers. Financial activities of the business eg receipt of fees are maintained separately from the persons personal financial activities eg house payment. Answer Venture entrepreneurship Proprietorship Partnership Corporation Answer.

Which of the items below is not a business entity. Which of the items below is NOT a business organization form. Since they are formed at the state level they must comply with state laws.

231k points 59 586 1857. For additional information refer to Small Business Administrations Choose a. You would think that a business would have a physical address but the reality is that business entities are.

1 an association taxed as a corporation 2 a partnership 3 a disregarded entity or 4 a trust. Business entities are organizations formed by one or more persons. Which of the items below is not a business entity.

Legal and tax considerations enter into selecting a business structure. You choose a business entity when you start a business. Which of the items below is not a business entity.

Experts are tested by Chegg as specialists in their subject area. Accounts Payable Service Revenue Accounts Receivable Wages Expense The ending balance of the retained earnings account appears in both the retained earnings statement and the statement of cash flows both. Who are the experts.

Individual Income Tax Return or Form 1040-SR US. Tax Return for Seniors by dividing the items of income gain loss deduction credit and expenses in accordance with their respective interests in such venture. So the entrepreneurship is not a item of business entity.

Trusts are not considered business entities see Regs. Answer Venture entrepreneurship Proprietorship Partnership Corporation. Asked in Other Sep 10 2021 36 views.

The concept of business entity in accounting is applicable to the all kinds of business organization which are partnership proprietorship and corporation. On May 30 White Repair Service accepted the sellers counteroffer of 115000. There are four broad groups of business entities.

February 2 2022 thanh. In most states a business owner is required to file documents with a particular state agency like the office of the Secretary of State in order to legally set up their business. On May 20 White Repair Service extended an offer of 108000 for land that had been priced for sale at 140000.

The individual and the business are considered to be the same entity for tax purposes. Get Answers Chief of LearnyVerse. Although a sole proprietorship is not a separate legal entity from its owner it is a separate entity for accounting purposes.

A business entity is an organization thats formed to conduct business. A limited liability company LLC is a unique form of business entity. Each spouse files with the Form 1040 or Form 1040-SR a.

Under the check-the-box entity-classification regulations an organization that is recognized for federal tax purposes as an entity separate from its owners can potentially be classified as. Both spouses must elect qualified joint venture status on Form 1040 US. Which of the items below is not a business entity.

Math Chemistry Biology Programming Arts History BusinessLanguage Spanish EnglishTipsReviewBlog Home Which the items below not business entity February 2022 thanh Which the items below not business organizationform. Its formed by filing paperwork with your state if required. An entity that is organized according to state or federal statutes and in which ownership is divided into shares of stock is a A.

It is not incorporated so that the sole owner is entitled to the entire net worth of the business and is personally liable for its debts. Which of the items below isnota business entity. This would cover not just manufacturing companies but also hospitals banks and more.

LLC owners are called members.

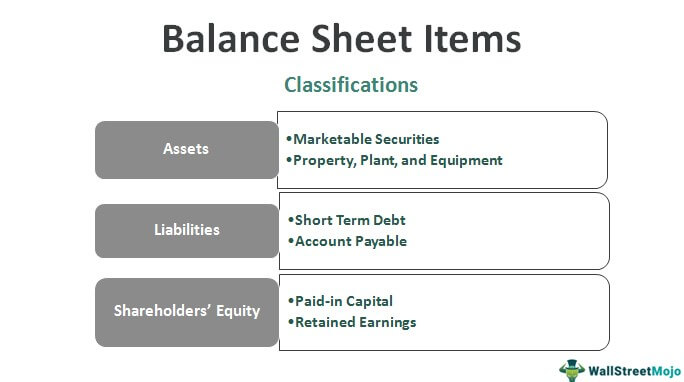

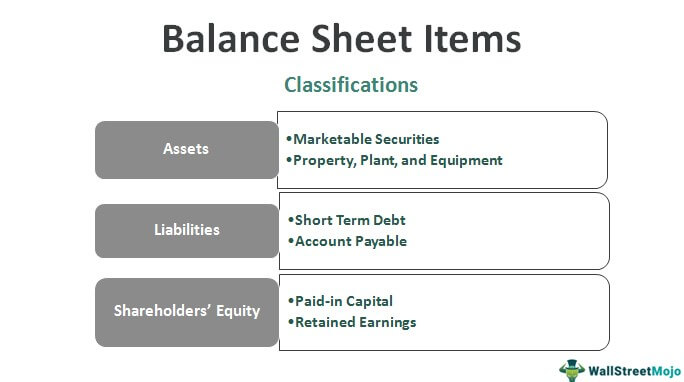

Balance Sheet Items List Of Top 15 Balance Sheet Items

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

Cash Flow Statement Analyzing Cash Flow From Investing Activities

:max_bytes(150000):strip_icc()/GENOte23saleonetimeitem-ef0a5df240b94d3c98042e62dca9b917.jpg)

/GEIncomestatementQ12020withHighlights-89082fdfdb0f4085ac6cc3123a76e322.jpg)

No comments for "Which of the Items Below Is Not a Business Entity"

Post a Comment